It’s hard to believe, but it’s that time of year again to start thinking about how to reduce your practice’s tax liability for 2025.

Section 179 of the IRS tax code, designed to encourage small businesses, including many private practices, to invest in their practice and allow them to deduct the full purchase price of qualifying equipment and/or software that has been purchased or financed during the tax year from their total gross income.

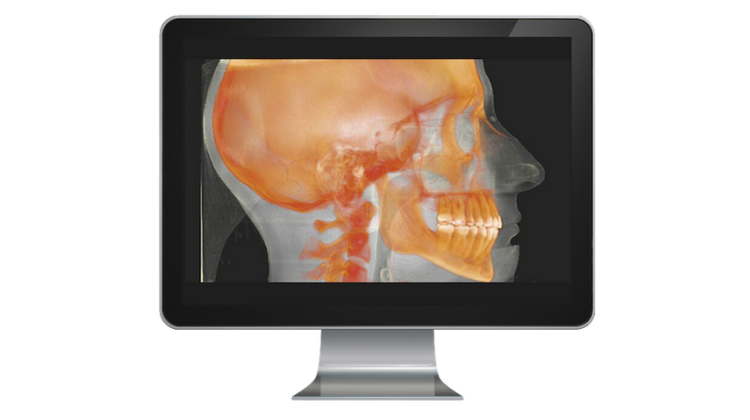

For dental practices, this means that the cost of capital equipment such as CBCT, digital X-ray machines, intraoral scanners, and even software can be fully or partially deducted from gross income. This means your practice can write off the full purchase amount this year and are no longer required to depreciate the equipment over time as they have in previous tax years.

Calculating this deduction effectively can help reduce tax liabilities and improve cash flow for practices. Here’s a guide to understanding and calculating the Section 179 deduction for dental imaging equipment.

%20(61)-1.png)

%20(60)-1.png)

%20(59)-1.png)

%20(58)-1.png)

%20(56)-1.png)

%20(55)-1.png)

%20-%202023-10-18T111909.581.png)

%20(54)-1.png)