Which Planmeca CBCT Option Is Best for My Dental Practice?

For over 40 years, Planmeca has consistently ranked as one of the leading manufacturers in the industry for digital dental imaging, providing a comprehensive line of panoramic, cephalometric and cone beam imaging systems. Planmeca’s technologies routinely receive high marks for image quality, dependability, and ease of use.

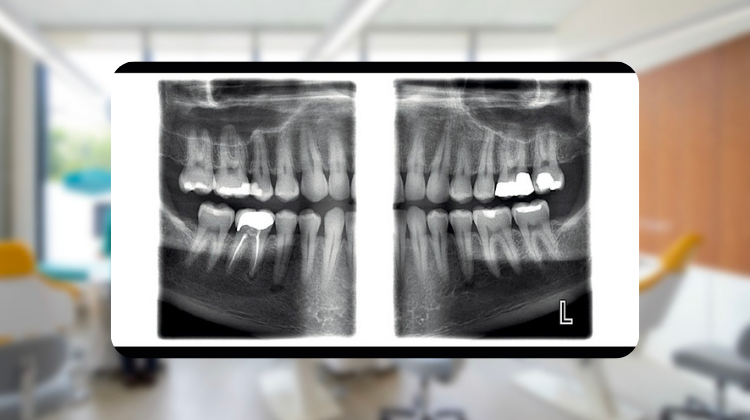

%20(99).png)

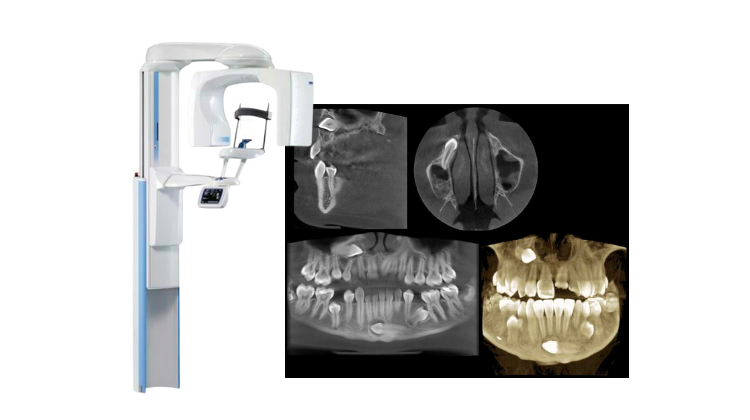

%20(44).png)