What Orthodontists Will Take Away from AAO 2026 in Orlando

Insights from Renew Digital + Voxel Dental

%20(62)-1.png)

Insights from Renew Digital + Voxel Dental

%20(61)-1.png)

In today’s economic climate, dental professionals are becoming more strategic with every investment—and digital imaging equipment is no exception. While cutting-edge imaging technology is essential for diagnostics and workflow efficiency, it doesn’t have to come with a premium price tag.

%20(60)-1.png)

In the world of dentistry, trust matters. Whether you’re placing an implant, diagnosing with 3D imaging, or investing in new technology, you need to know that your tools—and your partners—are reliable.

%20(59)-1.png)

The i‑CAT FLX has long been one of the most recognizable cone beam systems in dentistry. Known for its flexibility, solid image quality, and wide adoption among general dentists and specialists, the FLX remains a popular option for dentists and specialists alike.

%20(58)-1.png)

If you're planning to upgrade your dental imaging equipment in 2026, timing your purchase could save your practice thousands of dollars—and Renew Digital is here to help you do just that. Whether you're considering a certified pre-owned CBCT, a panoramic or cephalometric system, or an intraoral scanner, understanding when to buy can be just as important as what you buy.

%20(57)-1.png)

The American Association of Orthodontics (AAO) is an organization dedicated to promoting excellence in orthodontic care and education. Each year, the AAO hosts an annual meeting, which brings together orthodontic professionals from around the world to share knowledge, showcase the latest advancements in orthodontic technology and treatment techniques, and network with colleagues.

In our previous article, we reviewed the top 5 medium Field of View (FOV) CBCT systems that deliver a great value for your dental practice. This week, we're reviewing the top large FOV systems in 2026 for:

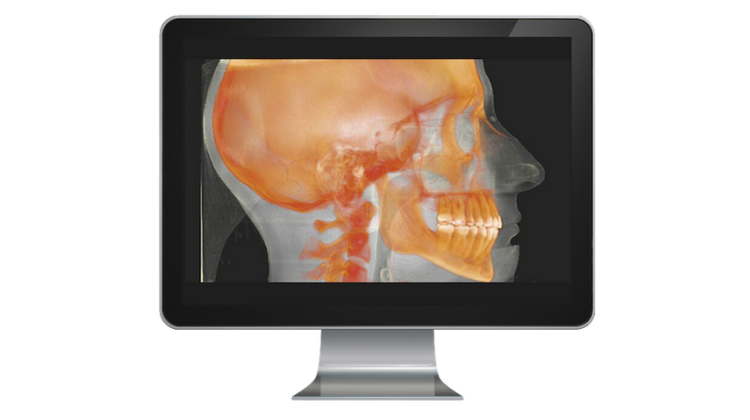

The increasing affordability of dental cone beam (otherwise called CBCT) technology has expanded the benefit of 3D imaging to a growing number of dentists and dental specialists.

In 2026, more practices are expected to make the jump to 3D imaging systems to allow for greater in-office clinical capabilities as well as more rapid treatment planning and case acceptance.

But... with so many cone beam machines available, which CBCT system is right for your practice?

%20(56)-1.png)

How to make the most of your next X-ray, CBCT, or intraoral scanner investment—without overspending

%20(55)-1.png)

Future-Proof Your Practice with the Right Technology—and the Right Upgrade Partner